Today’s Answer to the Long Term Care Crisis

Of couples (65+) experiencing a long term care event.

80% of people needing care receive it from friends and family.

Get up to ten times your premium deposit in LTC benefits.

Caregiving spouses are six times more likely to suffer depression.

Summary Explanation:

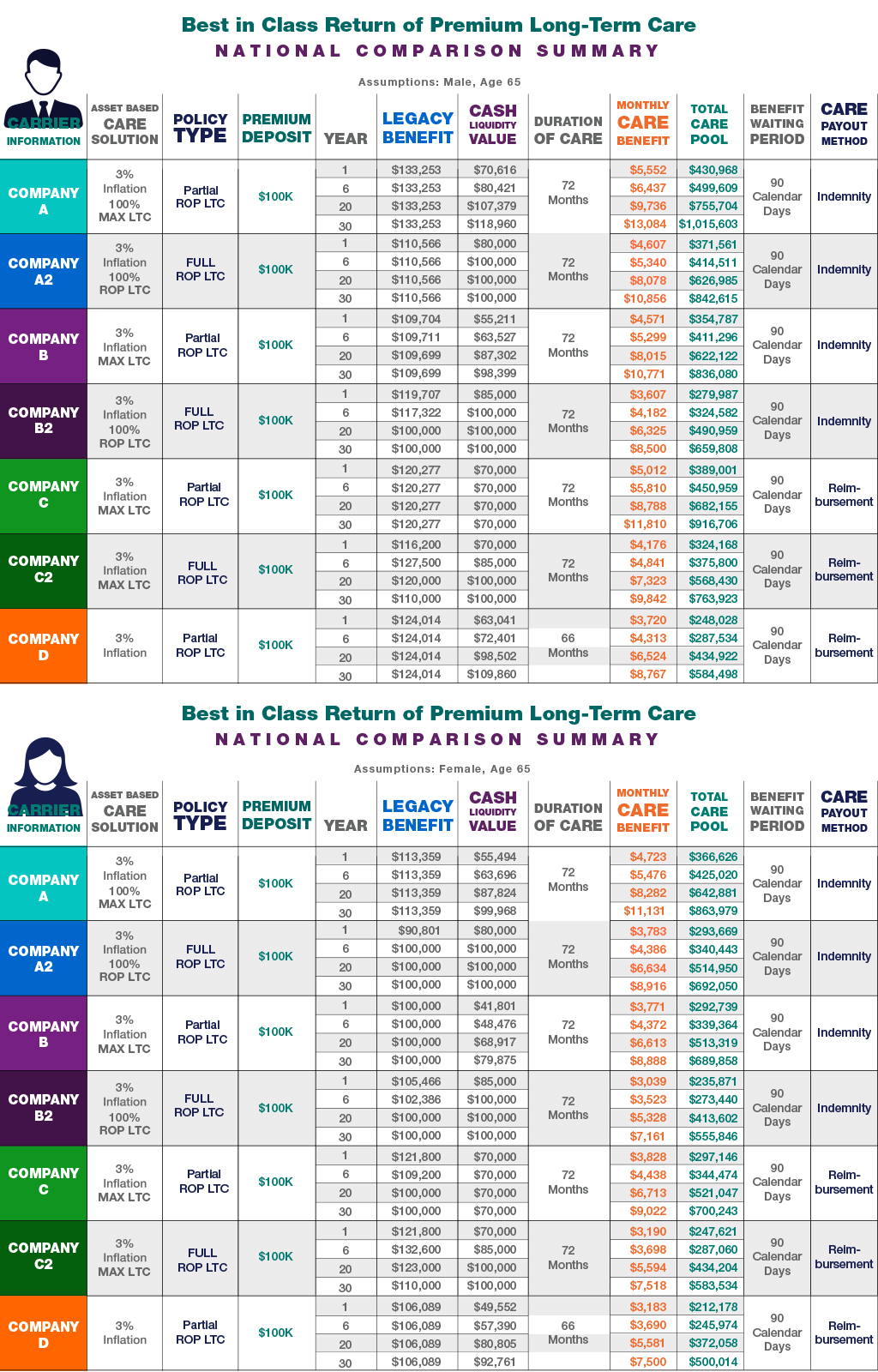

Teal – Company A: Currently provides the most competitive Partial ROP LTC policy in the country for both Reimbursement and Cash Indemnity monthly benefit payout options. Note: This policy generates the largest monthly LTC benefit, the largest total LTC care pool and the most Legacy (Life Insurance) Benefit of all ROP LTC plans. It is not available is all states.

Royal Blue – Company A2 (same as company A): Currently provides the most competitive Full ROP LTC policy in the country for both Reimbursement and Cash Indemnity monthly benefit payout options. Note: A full Return of Premium (ROP) is available beginning year six.

Violet – Company B: Currently provides the second most competitive Partial ROP LTC policy in the country for both Reimbursement and Cash Indemnity monthly benefit payout options. Note: This policy is available in all states.

Purple – Company B2 (same as company B): Currently provides the second most competitive Full ROP LTC policy in the country for both Reimbursement and Cash Indemnity monthly benefit payout options. Note: This policy is available in all states.

Lime Green – Company C and Green – Company C2: This carrier’s Partial and Full ROP LTC plans are the most common policies offered through “wire houses” (National Brokerage firms) in the country.

Orange – Company D: Currently provides the longest standing Partial ROP LTC plan. While it basic benefit “Duration of Care” is 66 months, for an additional deposit you can opt for an unlimited “lifetime” monthly benefit. Furthermore, you can use “qualified accounts”, like an IRA to fund it.

But I Don’t Want To Go To A Nursing Home

In the 1990s, when I began my career in the long term care insurance industry, the average age of our client was 68 years old. These people were part of either the Silent or Greatest Generations, having fought in World War II or Korea, and coming of age during the Great Depression. They were retired, which meant they were home during the day and available for a daytime appointment. Morning or afternoon was the ultimate “either/or” close, as we dutifully filled up our daytime slots. All that was left to decide was whether I would be intruding during The Young and the Restless or Jeopardy!

Not properly preparing for the exorbitant cost of long-term medical care

Life never goes according to plan. If we had a magic wand, we’d all peacefully die in our sleep on our 93rd birthday after living an invigorating life. That way we’d never have to be a burden on our children or spend a fortune during the last few years of our lives in an assisted living facility or a nursing home.

Long-Term Care Without Handcuffs

Last year, after finishing with college tuition for their three children, Jessica Galligan Goldsmith and her husband, James, treated themselves to something she had long wanted: long-term-care insurance.

It hasn’t been cheap. The couple, both lawyers in their mid-50s, will shell out more than $320,000 between them over a decade. For that, they will be able to tap into benefits topping $1 million apiece by the time they are in their 80s, the age when many Americans suffer from dementia or other illnesses that require full-time care.

My 2021 Strategy for the Long-Term Care (LTC) Crisis

It’s estimated that more than 72% of older Americans (65 and over) will require long-term care (LTC).

And there’s a 91% chance that, if you are married and over age 65, one of you will experience a long-term care event.

What’s more, the average lifetime cost of their long-term care will range between $250,000 and $370,000, depending on where you live.

Long Term Care Insurance — Act Now! By Terry Savage

One of the most tragic aspects of the coronavirus pandemic is that as of June 3, 42% of all COVID-19 deaths in the U.S. have come from nursing homes or assisted-living facilities. The statistics reinforce every senior’s desire to remain at home in his or her final years, which is only possible if you have the resources to afford this very expensive home health care — or if you have long-term care (LTC) insurance. Otherwise, state Medicaid programs provide care for the impoverished, though mostly in institutions.

Reduce Your Long-Term-Care Expenses by up to 90%

No one can predict a long-term-care medical event. But if it does happen, here is something to consider: An IRS-approved investment vehicle that lets you pre-pay (tax-free) for long-term care expenses… and can reduce your long-term-care expenses by up to a whopping 90%.

I was introduced to this unique care alternative by my old friend, David Phillips, who heads Phoenix-based Estate Planning Specialists. David calls it the “844 LTC Plan,” and every dollar you deposit into an 844 LTC Plan will balloon by 300%… 500%… even as much as 1,000% — depending on your age and when you begin.

Expert Recommendations

“David and Todd Phillips of Estate Planning Specialists, my go-to source for the best in life insurance, LTC and annuities.”

5 Myths about LTC

Time, distance, and both spouses working have made it more difficult for many families to provide all the care needed. Even if family members can find the time to provide care, it can often take its toll on the care giver. If you were suddenly in need of Long-Term Care, imagine the physical, emotional and financial burden it could cause your family. Long-Term Care Insurance can help preserve your independence without burdening others.

Pension Protection Act 2006

The Pension Protection Act was signed into law in August 2006 containing more than 900 pages of changes and refinements to regulations regarding defined benefit plans, defined contribution plans, individual retirement accounts and other issues related to retirement planning.

Hidden in the seemingly senseless banter are two secret treasures that few Americans know about.

How to use your IRA to fund ROP LTC

The most prudent way to insulate these precious funds is to implement what we call The IRA Leveraged LTC Strategy (IRA LLTC Strategy). Simply stated, with the IRA LLTC Strategy you transfer a portion of your “Qualified” funds, like your IRA into a special income annuity known as a 10-year Certain Immediate Annuity. Then annually for 10 years, you transfer the Annuity income into the Return of Premium LTC plan. Fully funding guaranteed Long Term Care protection that will leverage your transferred IRA up to 10 times!