Today’s Answer to the Long Term Care Crisis

Of couples (65+) experiencing a long term care event.

80% of people needing care receive it from friends and family.

Get up to ten times your premium deposit in LTC benefits.

Caregiving spouses are six times more likely to suffer depression.

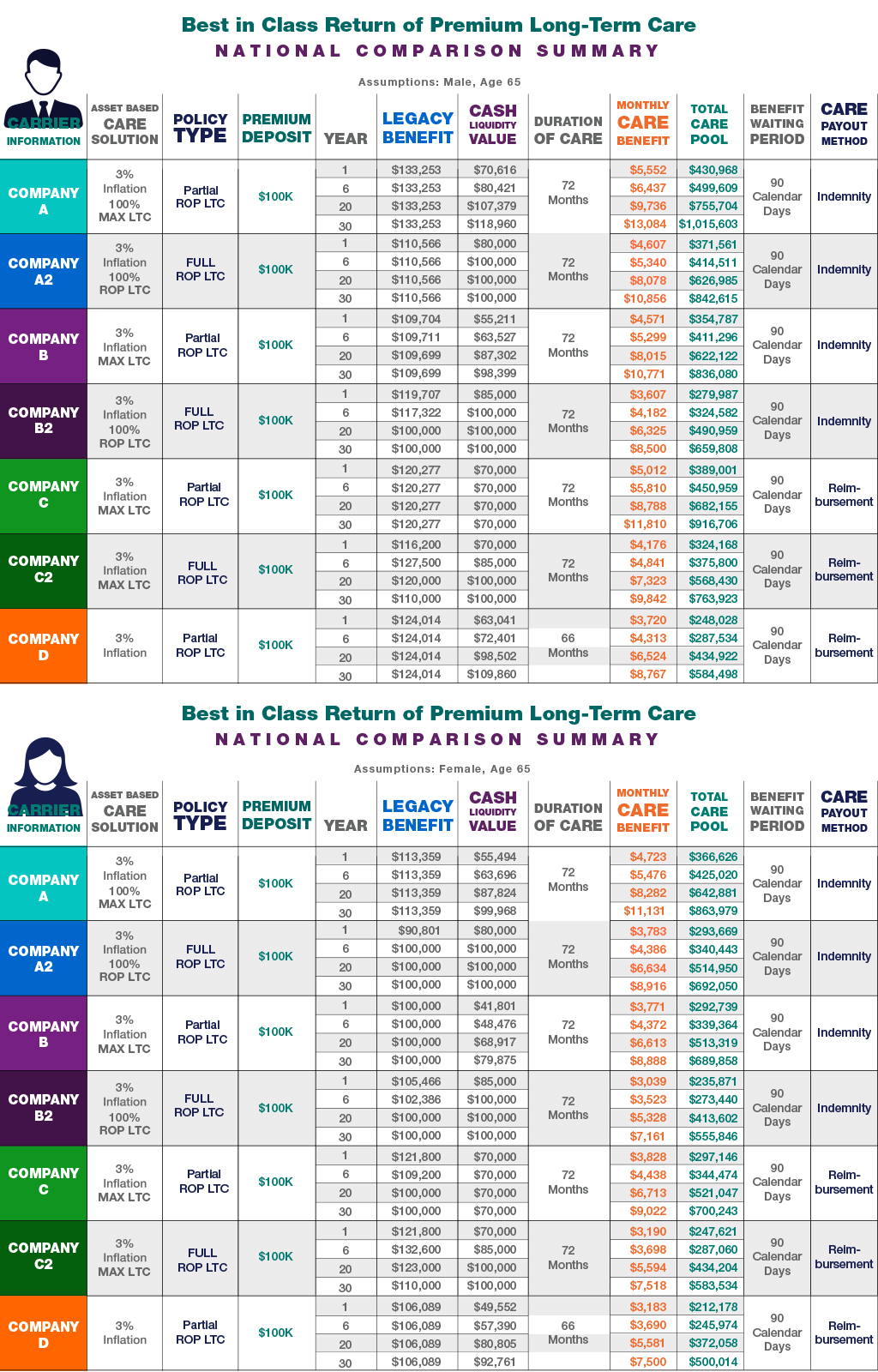

Summary Explanation:

Teal – Company A: Currently provides the most competitive Partial ROP LTC policy in the country for both Reimbursement and Cash Indemnity monthly benefit payout options. Note: This policy generates the largest monthly LTC benefit, the largest total LTC care pool and the most Legacy (Life Insurance) Benefit of all ROP LTC plans. It is not available is all states.

Royal Blue – Company A2 (same as company A): Currently provides the most competitive Full ROP LTC policy in the country for both Reimbursement and Cash Indemnity monthly benefit payout options. Note: A full Return of Premium (ROP) is available beginning year six.

Violet – Company B: Currently provides the second most competitive Partial ROP LTC policy in the country for both Reimbursement and Cash Indemnity monthly benefit payout options. Note: This policy is available in all states.

Purple – Company B2 (same as company B): Currently provides the second most competitive Full ROP LTC policy in the country for both Reimbursement and Cash Indemnity monthly benefit payout options. Note: This policy is available in all states.

Lime Green – Company C and Green – Company C2: This carrier’s Partial and Full ROP LTC plans are the most common policies offered through “wire houses” (National Brokerage firms) in the country.

Orange – Company D: Currently provides the longest standing Partial ROP LTC plan. While it basic benefit “Duration of Care” is 66 months, for an additional deposit you can opt for an unlimited “lifetime” monthly benefit. Furthermore, you can use “qualified accounts”, like an IRA to fund it.

With ROP LTC Plan, I now have options

I want to share with you a conversation I had the other day with a client when telling her the good news that she was approved for coverage for her Return of Premium Long Term Care Plan (ROP LTC).

An Answer To Today’s Long-Term Care Crisis

My favorite long-term care protection plan is improved and attractive to more people than before. You have more options than ever to help pay for future long-term care, and these newer options are significantly more appealing and rewarding than traditional long-term care insurance.

I’ve covered in the past the many troubles in traditional long-term care insurance (LTCI). Most insurers exited the market. Many of the remaining insurers continue to raise premiums on existing policyholders.