An Answer To Today’s Long-Term Care Crisis

How to use your IRA to fund ROP LTC

Long Term Care Insurance — Act Now! By Terry Savage

Long-Term Care Without Handcuffs

Not properly preparing for the exorbitant cost of long-term medical care

My 2021 Strategy for the Long-Term Care (LTC) Crisis

Reduce Your Long-Term-Care Expenses by up to 90%

Questions?

We have the answers about the Benefits of LTC Insurance.

Call: (888) 892-1102

Should you ever be in a position where you cannot perform 2 of the 6 Activities of Daily Living (ADLs) or you become cognitively impaired, you will receive a Cash Indemnity (no receipts required) monthly Tax-Free check for the time period you select (usually 6 years). You can include inflation benefit if you choose.

Should you pass away without receiving any monthly long-term care payments, your designated beneficiaries will receive a Life Insurance benefit that is, at a minimum, equal to the deposit or deposits you have made. Should you pass away after using the entire LTC pool, a residual life insurance benefit of up to a maximum $10,000 is still paid out to your beneficiaries.

If you need your deposit back for an unforeseen event, you have full liquidity after 5 years or at the end of your funding period. For example, a lump sum funded plan will be totally liquid at the end of 5 years, a 10-year funded plan will be totally liquid at the end of 10 years.

Here’s how

The Return of Premium

Long-Term Care Plan works

The ROP LTC Plan is an insurance contract that provides an IRS-approved monthly long-term care benefit that is derived from a leveraged pool of money that is created from funds you transfer to the insurance company.

With the ROP LTC plan you either transfer a lump sum or make multiple deposits that establishes a fully paid up life insurance policy. This creates a long-term care benefit that is instantly valued many times greater than your deposit, whenever the LTC benefit is triggered.

When you trigger the LTC benefit you receive an augmented monthly Tax-Free long-term care benefit each month, up to the period of time you initially select (usually 72 months). To initiate the LTC benefit you simply have a medical professional confirm that you are either cognitively impaired (dementia or Alzheimer) or cannot perform 2 of the 6 Activities of Daily Living (ADLs): bathing, continence, dressing, eating, toileting and transferring.

Heads you win: For every $50,000 you deposit into the ROP LTC Plan, if you trigger the LTC provision, depending on your initial age, you will receive $150,000, $200,000, $400,000, $500,000 or more in long term care dollars for you to use however you see fit. Be it paying for care in a facility or in your own home.

Tails you win: Although the odds are extremely high (72%) that most Americans will require long-term care, we all hope that we won’t. If you don’t, your spouse or other designated beneficiaries will receive up to or greater than your deposit in a Tax-Free life insurance benefit.

Because the ROP LTC Plan is a Cash Indemnity payout, the monthly benefit can be used for a wide variety of care, including care from a professional caregiver or even informal care from family and friends. In short, you can access the dollars from your Return of Premium LTC Plan to pay for anything.

Summary Explanation:

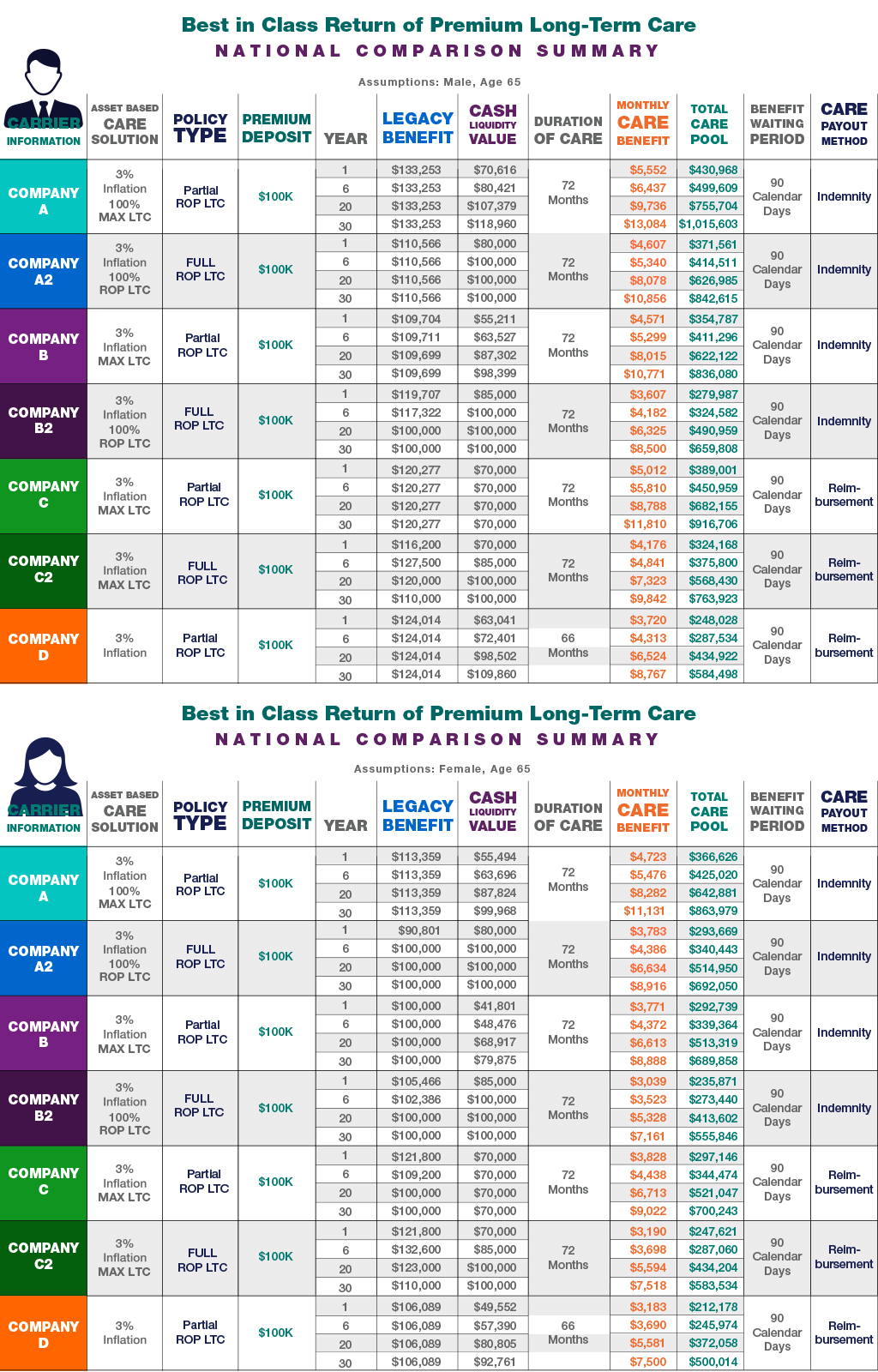

Teal – Company A: Currently provides the most competitive Partial ROP LTC policy in the country for both Reimbursement and Cash Indemnity monthly benefit payout options. Note: This policy generates the largest monthly LTC benefit, the largest total LTC care pool and the most Legacy (Life Insurance) Benefit of all ROP LTC plans. It is not available is all states.

Royal Blue – Company A2 (same as company A): Currently provides the most competitive Full ROP LTC policy in the country for both Reimbursement and Cash Indemnity monthly benefit payout options. Note: A full Return of Premium (ROP) is available beginning year six.

Violet – Company B: Currently provides the second most competitive Partial ROP LTC policy in the country for both Reimbursement and Cash Indemnity monthly benefit payout options. Note: This policy is available in all states.

Purple – Company B2 (same as company B): Currently provides the second most competitive Full ROP LTC policy in the country for both Reimbursement and Cash Indemnity monthly benefit payout options. Note: This policy is available in all states.

Lime Green – Company C and Green – Company C2: This carrier’s Partial and Full ROP LTC plans are the most common policies offered through “wire houses” (National Brokerage firms) in the country.

Orange – Company D: Currently provides the longest standing Partial ROP LTC plan. While it basic benefit “Duration of Care” is 66 months, for an additional deposit you can opt for an unlimited “lifetime” monthly benefit. Furthermore, you can use “qualified accounts”, like an IRA to fund it.