An Answer To Today’s Long-Term Care Crisis

How to use your IRA to fund ROP LTC

Long Term Care Insurance — Act Now! By Terry Savage

Long-Term Care Without Handcuffs

Not properly preparing for the exorbitant cost of long-term medical care

My 2021 Strategy for the Long-Term Care (LTC) Crisis

Reduce Your Long-Term-Care Expenses by up to 90%

Questions?

We have the answers about the Benefits of LTC Insurance.

Call: (888) 892-1102

By David T. Phillips, CEO

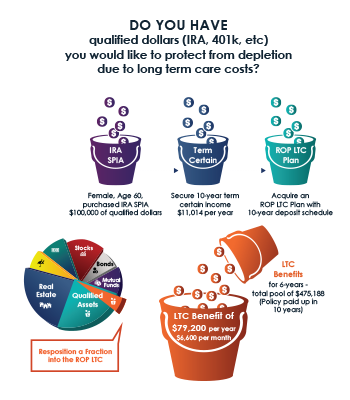

Many of our clients have qualified assets (IRA/401k, etc) they intend to use for retirement income. However there is one unknown factor that could unwind the best laid plans – Long Term Care (LTC) expenses.

The most prudent way to insulate these precious funds is to implement what we call The IRA Leveraged LTC Strategy (IRA LLTC Strategy). Simply stated, with the IRA LLTC Strategy you transfer a portion of your “Qualified” funds, like your IRA into a special income annuity known as a 10-year Certain Immediate Annuity. Then annually for 10 years, you transfer the Annuity income into the Return of Premium LTC plan. Fully funding guaranteed Long Term Care protection that will leverage your transferred IRA up to 10 times!

Because the income generated from the Immediate Annuity will be taxed annually as a “Qualified” distribution, income taxes will be due April 15th of the year following the distribution. However, considering that you would have had to pay taxes on the IRA distribution down the road at potentially higher tax rates, and the immense leverage you generate, the small conversion tax you pay to obtain the IRA LLTC Strategy today is well worth it.

LET’S LOOK AT AN EXAMPLE

LET’S LOOK AT AN EXAMPLE

Allison, 60, is in good health and married. She is concerned about Long Term Care after seeing how those expenses impacted her parents’ retirement plans. Allison’s parents thought they were all set, (and they were), until extended care expenses depleted their savings.

Allison’s father passed away first after a long illness. His extended LTC expenses significantly impacted her mother’s plans. You see she had hoped to travel with her friends after her husband’s passing, but because most of their retirement money was spent on his care, her plans took a back seat. Then to make matters worse, her mother had three years of LTC expenses of her own. The money she was hoping to leave her family evaporated. It was gone.

THE STRATEGY

This was a wake-up call for Allison. After discussing her situation with us, she decided an ROP LTC Plan would best fit her needs. She really liked the flexibility and simplicity of the Tax-Free Cash Indemnity monthly payout. With no restrictions on how LTC benefits can be used, Allison will be able to use her tax free cash to pay for a variety of needs that may not be covered by the typical reimbursement LTC policy. Benefits such as using her monthly payout to cover the costs of informal care from an immediate family member, or hiring less expensive and potentially more accessible unlicensed caregivers.

After getting approval for her Return of Premium LTC plan, she transferred $100,000 from her IRA into a 10-year Certain Income Annuity that produced a taxable annual income of $11,014 of which she is now using to fully pay up her ROP LTC Plan without an inflation rider.

Allison decided to pay taxes due on the annuity distribution out of pocket to preserve more funds for her ROP LTC plan. Her premium is guaranteed to remain the same and the policy will be fully paid up in 10 years. Her 10 year IRA conversion will generate an immediate and perpetual leveraged LTC benefit totaling $475,188 ($4.75 to $1) – $6,600 per month, for 72 months. In addition, should Allison pass away without needing her LTC benefits, there is a life insurance benefit of $158,396 that will be paid tax-free to her beneficiaries ($1.58 to $1).

Had Allison decided to choose the 5% Simple Inflation Rider her immediate LTC pool would have been $293,666. In 20 years, at age 80 it would have increase to $541,650 or $7,070 a month for 72 months. Fully guaranteed!

Now that’s what I call leverage!

To receive your own personalized example of how the IRA Leveraged LTC Strategy could work for you call 1-888-892-1102 or complete the ROP LTC Request Form by clicking the button below.

Click Here to Complete The Return of Premium Long Term Care Analysis Request