Should you ever be in a position where you cannot perform 2 of the 6 Activities of Daily Living (ADLs) or you become cognitively impaired, you will receive a Cash Indemnity (no receipts required) monthly Tax-Free check for the time period you select (usually 6 years). You can include inflation benefit if you choose.

Should you pass away without receiving any monthly long-term care payments, your designated beneficiaries will receive a Life Insurance benefit that is, at a minimum, equal to the deposit or deposits you have made. Should you pass away after using the entire LTC pool, a residual life insurance benefit of up to a maximum $10,000 is still paid out to your beneficiaries.

If you need your deposit back for an unforeseen event, you have full liquidity after 5 years or at the end of your funding period. For example, a lump sum funded plan will be totally liquid at the end of 5 years, a 10-year funded plan will be totally liquid at the end of 10 years.

Here's how

The Return of Premium

Long-Term Care Plan works

The ROP LTC Plan is an insurance contract that provides an IRS-approved monthly long-term care benefit that is derived from a leveraged pool of money that is created from funds you transfer to the insurance company.

With the ROP LTC plan you either transfer a lump sum or make multiple deposits that establishes a fully paid up life insurance policy. This creates a long-term care benefit that is instantly valued many times greater than your deposit, whenever the LTC benefit is triggered.

When you trigger the LTC benefit you receive an augmented monthly Tax-Free long-term care benefit each month, up to the period of time you initially select (usually 72 months). To initiate the LTC benefit you simply have a medical professional confirm that you are either cognitively impaired (dementia or Alzheimer) or cannot perform 2 of the 6 Activities of Daily Living (ADLs): bathing, continence, dressing, eating, toileting and transferring.

Heads you win: For every $50,000 you deposit into the ROP LTC Plan, if you trigger the LTC provision, depending on your initial age, you will receive $150,000, $200,000, $400,000, $500,000 or more in long term care dollars for you to use however you see fit. Be it paying for care in a facility or in your own home.

Tails you win: Although the odds are extremely high (72%) that most Americans will require long-term care, we all hope that we won’t. If you don’t, your spouse or other designated beneficiaries will receive up to or greater than your deposit in a Tax-Free life insurance benefit.

Because the ROP LTC Plan is a Cash Indemnity payout, the monthly benefit can be used for a wide variety of care, including care from a professional caregiver or even informal care from family and friends. In short, you can access the dollars from your Return of Premium LTC Plan to pay for anything.

Here's how

The Return of Premium

Long-Term Care Plan works

The ROP LTC Plan is an insurance contract that provides an IRS-approved monthly long-term care benefit that is derived from a leveraged pool of money that is created from funds you transfer to the insurance company.

With the ROP LTC plan you either transfer a lump sum or make multiple deposits that establishes a fully paid up life insurance policy. This creates a long-term care benefit that is instantly valued many times greater than your deposit, whenever the LTC benefit is triggered.

When you trigger the LTC benefit you receive an augmented monthly Tax-Free long-term care benefit each month, up to the period of time you initially select (usually 72 months). To initiate the LTC benefit you simply have a medical professional confirm that you are either cognitively impaired (dementia or Alzheimer) or cannot perform 2 of the 6 Activities of Daily Living (ADLs): bathing, continence, dressing, eating, toileting and transferring.

Should you ever be in a position where you cannot perform 2 of the 6 Activities of Daily Living (ADLs) or you become cognitively impaired, you will receive a Cash Indemnity (no receipts required) monthly Tax-Free check for the time period you select (usually 6 years). You can include inflation benefit if you choose.

Should you pass away without receiving any monthly long-term care payments, your designated beneficiaries will receive a Life Insurance benefit that is, at a minimum, equal to the deposit or deposits you have made. Should you pass away after using the entire LTC pool, a residual life insurance benefit of up to a maximum $10,000 is still paid out to your beneficiaries.

If you need your deposit back for an unforeseen event, you have full liquidity after 5 years or at the end of your funding period. For example, a lump sum funded plan will be totally liquid at the end of 5 years, a 10-year funded plan will be totally liquid at the end of 10 years.

Heads you win: For every $50,000 you deposit into the ROP LTC Plan, if you trigger the LTC provision, depending on your initial age, you will receive $150,000, $200,000, $400,000, $500,000 or more in long term care dollars for you to use however you see fit. Be it paying for care in a facility or in your own home.

Tails you win: Although the odds are extremely high (72%) that most Americans will require long-term care, we all hope that we won’t. If you don’t, your spouse or other designated beneficiaries will receive up to or greater than your deposit in a Tax-Free life insurance benefit.

Because the ROP LTC Plan is a Cash Indemnity payout, the monthly benefit can be used for a wide variety of care, including care from a professional caregiver or even informal care from family and friends. In short, you can access the dollars from your Return of Premium LTC Plan to pay for anything.

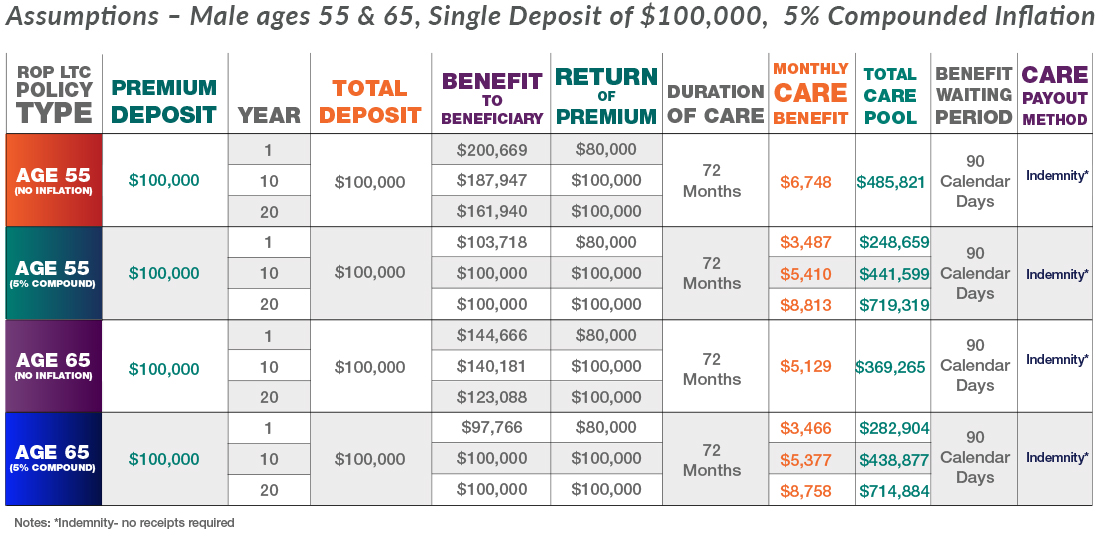

The New Return of Premium

Long Term Care Plan (Examples):

What to Do Next...

Complete the ROP LTC Analysis Request Form by clicking the Get a Quote button below. We will contact you to confirm your information and will send you a detailed outline of the best ROP LTC Plan in America today, based on your objectives. No hassles, no obligation and no pressure.

Of course, if you have any questions please feel free to call 1-888-892-1102

But I Don’t Want To Go To A Nursing Home

By Don Levin, JD, MPA, CLF, CSA, LTCP, CLTC -August 1, 2020

In the 1990s, when I began my career in the long term care insurance industry, the average age of our client was 68 years old. These people were part of either the Silent or Greatest Generations, having fought in World War II or Korea, and coming of age during the Great Depression. They were retired, which meant they were home during the day and available for a daytime appointment. Morning or afternoon was the ultimate “either/or” close, as we dutifully filled up our daytime slots. All that was left to decide was whether I would be intruding during The Young and the Restless or Jeopardy! They usually were comfortably retired with a pension to support them (Social Security was often thought of as an “extra”), in a home that was mortgage-free, and there was no such thing as credit card debt for these folks. Nonetheless, they were just worried enough, or practical enough, about the potential cost and risk of going to a nursing home that they would tear off the card, fill in their personal data, and send the (lead) card back to the carrier who in turn would give it to someone like me so that I could call to set an appointment that would take place at their kitchen table.

In the 1990s, when I began my career in the long term care insurance industry, the average age of our client was 68 years old. These people were part of either the Silent or Greatest Generations, having fought in World War II or Korea, and coming of age during the Great Depression. They were retired, which meant they were home during the day and available for a daytime appointment. Morning or afternoon was the ultimate “either/or” close, as we dutifully filled up our daytime slots. All that was left to decide was whether I would be intruding during The Young and the Restless or Jeopardy! They usually were comfortably retired with a pension to support them (Social Security was often thought of as an “extra”), in a home that was mortgage-free, and there was no such thing as credit card debt for these folks. Nonetheless, they were just worried enough, or practical enough, about the potential cost and risk of going to a nursing home that they would tear off the card, fill in their personal data, and send the (lead) card back to the carrier who in turn would give it to someone like me so that I could call to set an appointment that would take place at their kitchen table.

Today, our clients may be Baby Boomers or Gen-Xers, as young as in their 40s and 50s or well into their 60s and 70s. While some are retired, most are not, still finding themselves working out of necessity as they prepare for a longer retirement with a defined contribution plan at best, Social Security filling a prominent amount of household revenue, a freshly re-financed mortgage because of the incredibly low interest rates and with student loans for their children and/or debt from the care of their parents. For those who have been caregivers or experienced writing the checks for parents requiring facility care, they are more than aware of the burden and financial devastation associated with long term care. Because of conflicting work schedules, we are now required to conduct an evening appointment that we consummate via Zoom and by sharing our computer screen to illustrate the various and sundry plans but also to complete the application electronically.

Some six months into the pandemic and the end of three months of staying close to home, there is no doubt that COVID-19 continues to be a huge wakeup call for a large number of people now faced with the daunting task of confronting both their morbidity and mortality. Our producers have received calls from individuals, as well as strategic partners in both the financial services industry and the practice of law, for assistance with their respective clients—all of whom want to guard against the potential of having to enter a long term care facility which has proven to be a deadly experience for a great number of Americans in 2020.

For some of us, who have fortunately avoided contracting COVID-19 by observing strict social distancing and the wearing of a mask when we do venture out from the safety of home, this pandemic has revealed the shortcomings and impracticalities of relying on family. While our children will always be busy with their own families, careers, and life challenges, the pandemic has cast a harsh reminder that one parent can care for five children, but five children may not always be able to care for one parent. The inability to travel and the fear of transmitting or contracting a deadly disease will definitely be a challenge to caregiving in the future.

In the course of talking to clients, as well as other professionals, I have not heard anyone clamoring for the opportunity to be placed in a skilled nursing facility; more than ever people want to stay within the secure and comfortable confines of their own home. These long term care facilities, often frequented by the elderly at the end of their lives, have been absolutely ravaged by the pandemic as residents and caregiving staff alike have succumbed to the coronavirus.

Some twenty-five years ago while still practicing law in Chicago, I helped move my maternal grandmother to a very nice skilled nursing facility. No longer able to reside in my mother’s home, her Parkinson’s, as well as related dementia and a broken hip, made the change in venue a necessary one. My grandmother was an elegant woman with well-coiffed hair and air of dignity about her. I saw her lose that dignity during her stay in the facility.

The cost in 1995 was $5,100 per month, but the average bill we received for payment from her assets usually exceeded $6,200 each and every month. While I had the option of paying five dollars and dining with her, consuming a lovely meal in the dining room where the tables were replete with linen table cloths, beautiful crystal, china, and silver tableware, when it came to care I was brought face to face with the ugly truth that there are certain things a man should never be called upon to do: Namely changing his grandmother’s diaper. My wife or I would pop in once or twice daily, and would often find my grandmother with a wet diaper. We would hit the call button, and after twenty minutes had gone by, find it easier to change the diaper ourselves. As one of my clients recently said to me, “Yeah, I want to pay big money to go to a facility and to have my basic needs ignored.”

I had occasion to visit a rather upscale facility in Houston, TX, last summer, long before the pandemic was on our horizon, and, candidly, I was uncomfortable from the time I entered until I left. The “smell” of the facility and the vacant stares of people seated strapped into wheelchairs or into beds, often sedated, only added to my level of discomfort and angst. The contrast offered by home health care never looked more appealing to me and made me grateful for the long term care insurance policy that is a cornerstone of our long term protection and financial plan.

The cost of care is going to continue to go up for any number of reasons. Annual increases in costs for care in facilities is nothing new, but now home care costs are increasing at a quicker pace as well. Care provided by home health care aides is now costlier than ever due to a variety of factors that include the following (based on preliminary research conducted with care providers from September 25 to October 3, 2018):

- Previously record low unemployment

- Wage pressures

- Regulatory changes

- Labor shortages

- More chronically ill patients

- Employee retention challenges

Covid-19 is exacerbating an already difficult situation.

If there is a silver lining to this otherwise dark cloud it is in the form of a wider spectrum of product offerings that we can make available to a general public committed more than ever to avoiding time in a long term care facility. Traditional long term care insurance remains the best means by which to leverage existing assets and cash flow in terms of premium paid and immediate access to policy benefits. Life insurance, living benefits, and annuities with varying riders that provide long term care protection also provide the practitioner and the policyowner with greater latitude in establishing a plan that is custom tailored to fit the needs, wants and desires of the policyowner.

This wide range of product offerings also provides more options to incorporate the concept of co-insuring the associated risks and costs of long term care if this is a desire of the consumer seeking protection.

Many are making the need for long term care an essential element of not only their financial plan, but also their long term vision as they contemplate where they want to receive their care. Many 55-and-older senior living communities are incorporating these physical needs into their floor plans and new construction. As a result, people are purchasing homes without stairs, with wide hallways and doorways that will accommodate a wheelchair or that are already equipped with grab bars and ramps in lavatories and key areas. If these items are not present, traditional long term care insurance plans have very generous allowances for home and equipment modification.

At the present time, 69 percent of all new long term care insurance claims originate with care beginning in a home environment. Later generations of these policies have placed an emphasis on keeping policyholders in this environment for as long as possible because it is more often than not cheaper for the carrier as well as better and more desirable for the policyholder. In the event the policyholder elects to move to an assisted living facility, either for socialization or medically-required treatment or custodial care, this is still a viable alternative for about 16 percent of claimants. For these reasons, only 15 percent end up in the skilled nursing facility where they will typically remain until death.

Older policies may very well offer alternate plans of care. We have found carriers often are very flexible in interpreting or establishing these alternate plans of care because they recognize that staying at home is a better scenario for the policyholder, the family, the caregivers, and the carrier. The home health care industry has literally exploded in the last several years as this critical need is being addressed by a wide range of entrepreneurs willing to address and answer this critical question of supply and demand.

Often overlooked is the consideration that family members are more apt to visit a private home rather than the facility and to do so on a more frequent basis. Family members do not feel as “freaked out” when visiting a loved one in the family home as they do when doing so in a facility. They are apt to stretch out the visit and stay longer, and may even spend the night if a long distance/travel is required to achieve the visit.

There is no doubt that everyone is happier with a private residential care scenario that also precludes the aforementioned ominous and distinctive smell of the facility. Often overlooked is the psychological impact of the nursing home on the family members as well as the patient.

At present, one in every six adults in the United States is an unpaid caregiver. That translates to 44 million caregivers. While most of these caregivers will provide the care for a spouse or parent when called upon to do so, the vast majority would most assuredly prefer to supervise the full time caregivers for which a long term care insurance policy will pay. Long term care insurance is of great assistance to them, and truly protects the family caregiver as much as it does the person requiring care by sparing them the physical, emotional and financial/career agonies ancillary to providing this care. In a large number of cases, family caregivers are worn down by this demanding responsibility and their own subsequent need for care is precipitated by this faithful service to a loved one. A long term care insurance policy is a great resource in that it provides choice and an alternative to the facility.

The key to procuring this protection is to do it while both young and healthy enough to qualify for coverage. While we pay for the associated premiums with our money, we buy this protection with our health.